Investment Wisdom

The books, resources, and wisdom that shape our investment philosophy and guide our decision-making process

The books, resources, and wisdom that shape our investment philosophy and guide our decision-making process

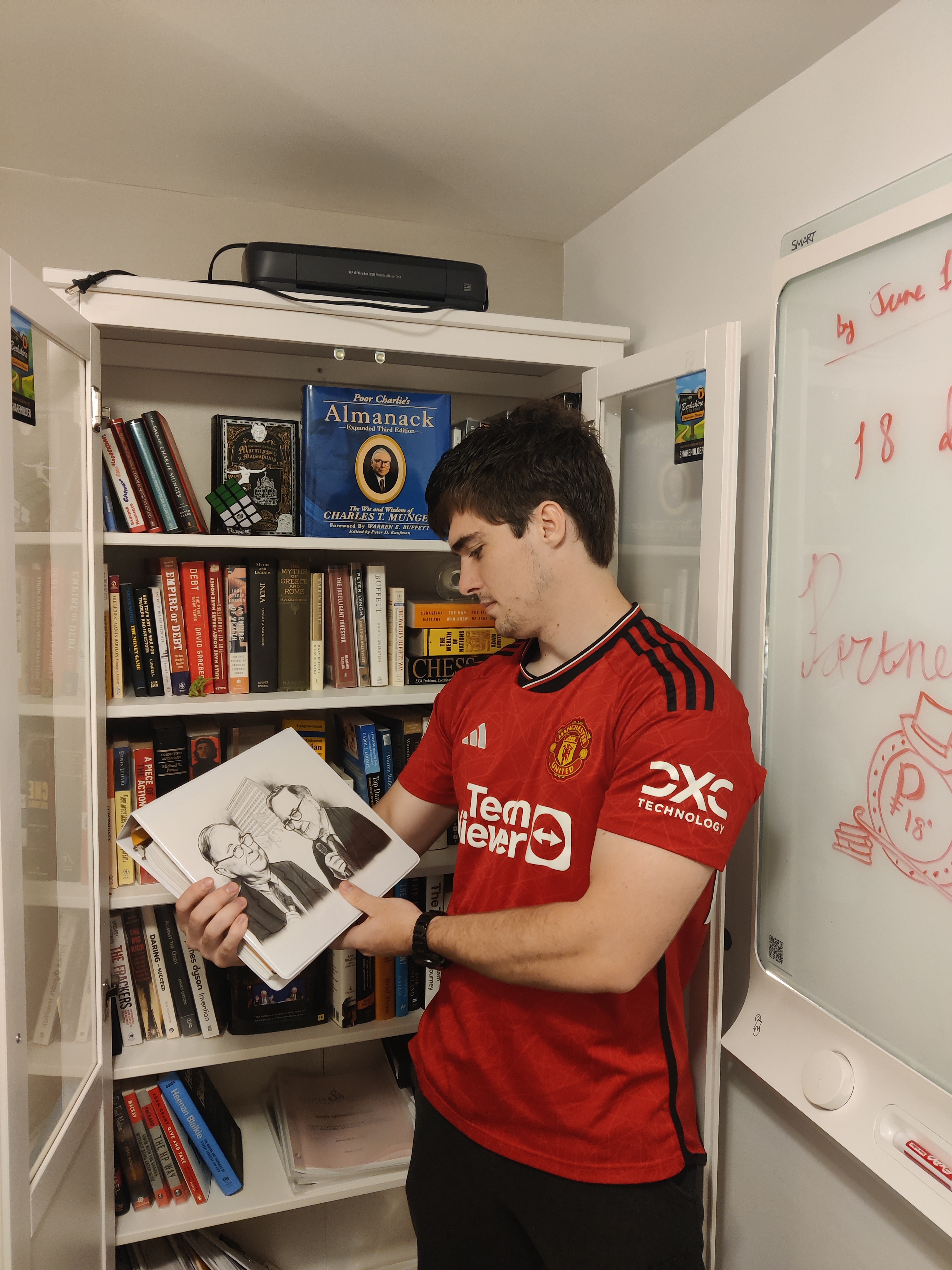

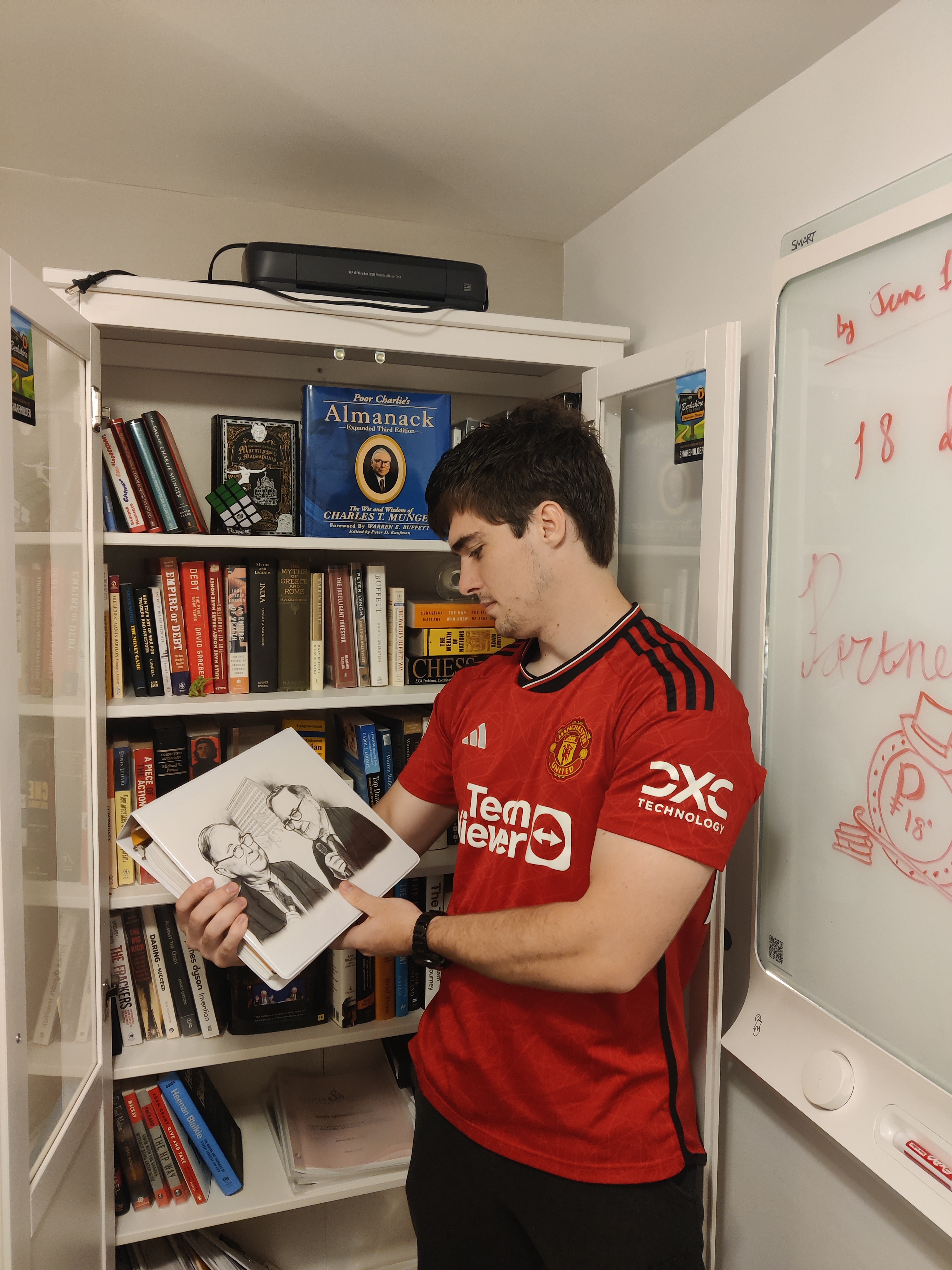

Multiple books in progress - the way real readers actually read

Barbara Freese

Energy & HistoryA human history of coal and its transformative impact on civilization. Understanding energy transitions and their economic implications.

Li Zhigang

E-commerceInside look at China's e-commerce giant and its competition with Alibaba. Insights into Chinese business culture and logistics innovation.

Various Authors

Investment WisdomCandid conversations and insights from the masters of value investing. Timeless wisdom beyond the annual letters.

Jean-Noël Kapferer

Business StrategyHow luxury brands create value through scarcity and exclusivity. Understanding premium business models and pricing power.

Tae Kim

TechnologyJensen Huang's leadership and NVIDIA's transformation from graphics to AI. Understanding the semiconductor industry and AI revolution.

Kirsten Grind

BankingThe rise and fall of Washington Mutual. Lessons in banking, risk management, and corporate governance failures.

Fresh insights from our latest reading adventures

Duncan Clark

The remarkable story of Jack Ma and Alibaba's rise to become China's e-commerce giant. Insights into Chinese entrepreneurship and global expansion.

Buy on AmazonLeigh Gallagher

How three founders disrupted the hospitality industry and created a global platform. Lessons in scaling marketplace businesses.

Buy on AmazonJohn Brooks

Twelve classic tales from Wall Street. Timeless stories of corporate drama, market psychology, and business strategy from the 1960s.

Buy on AmazonMichael Lewis

How data analytics revolutionized baseball and business. A masterclass in finding value where others see inefficiency.

Buy on AmazonBrett Gardner

Analysis of Warren Buffett's early investment decisions and the formation of his value investing approach. Understanding his evolution as an investor.

Buy on AmazonSean McMeekin

The global revolution and its impact on international markets. Understanding political risk and its investment implications.

Buy on AmazonVarious Authors

Inside China's tech giant and its global expansion strategy. Understanding telecommunications infrastructure and geopolitics.

Buy on AmazonJens Andersen

How a Danish carpenter built a global toy empire. Lessons in brand building, innovation, and family business management.

Buy on AmazonErnest Scheyder

The struggle for control of lithium and the future of energy. Understanding critical minerals and the green transition.

Buy on AmazonEd Catmull

Building a creative culture at Pixar. Insights into managing creative teams and fostering innovation in corporate environments.

Buy on AmazonThe foundational texts every value investor should study

Benjamin Graham

The definitive book on value investing. Graham's timeless principles form the foundation of intelligent investing and risk management.

Benjamin Graham & David Dodd

The comprehensive guide to analyzing securities and determining intrinsic value. Essential for understanding fundamental analysis.

Charlie Munger

Munger's wit and wisdom on investing, psychology, and life. Essential for understanding multidisciplinary thinking.

Daniel Kahneman

Understanding cognitive biases and decision-making. Critical for avoiding common investment mistakes.

Warren Buffett

Buffett's shareholder letters compiled into lessons on business and investing. Practical wisdom from the Oracle of Omaha.

Burton Malkiel

Understanding market efficiency and the challenges of beating the market. Essential counterpoint to active investing.

Books and topics we're exploring to expand our investment perspective

Essential podcasts and resources that have shaped our investment journey

by David Senra

Biographies of history's greatest entrepreneurs distilled into practical lessons for builders and investors.

by Ben Gilbert & David Rosenthal

Deep dives into the stories behind the greatest companies ever built. Masterful storytelling meets rigorous business analysis.

Both podcasts excel at extracting transferable mental models from business history

Deep financial and strategic analysis of what makes companies successful

Practical lessons for identifying exceptional investment opportunities

The timeless classic that started it all

by George S. Clason

The foundational text on wealth building through timeless parables from ancient Babylon. Essential wisdom on saving, investing, and building wealth that remains as relevant today as it was nearly a century ago.

"A part of all you earn is yours to keep. It should be not less than a tenth no matter how little you earn."

The foundation of the "pay yourself first" principle that every investor should follow.

Dive deeper into the quotes and wisdom that guide our investment philosophy

Follow our newsletter for book reviews, market insights, and investment commentary

Subscribe to NewsletterPersonally, I enjoy reading a lot of the text on my Kindle. The Scribe has been excellent at taking notes and reading PDFs, while the smaller models for books would recommend to check out for a more focused reading experience.